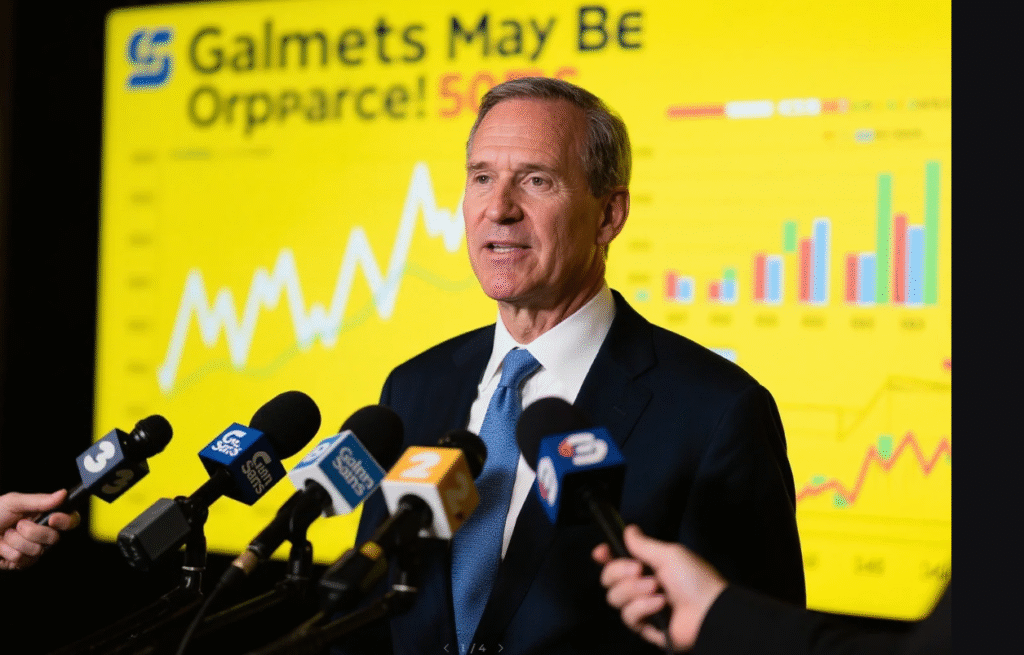

Markets May Be Overpricing 50 Basis Point Fed Cut, Goldman Sachs CEO Warns

Don’t just sign up — trade smarter and save 20% with referral codes: Binance WZ9KD49N / OKX 26021839

Introduction

- Overview of Federal Reserve’s 2025 interest rate cut expectations

- Goldman Sachs CEO’s statement: 50 basis point Fed cut unlikely

- Impact of CEO’s remarks on market pricing and investor sentiment

Context – Fed Policy and Market Expectations

Recent Fed Policy Stance and Inflation Trends

- Fed’s cautious approach amid sticky inflation above 2% target

- Influence of tariffs and labor market dynamics on policy decisions

Market Bets: 25bp vs. 50bp Rate Cut Probabilities

- Futures market pricing: 87% for 25bp, ~11.7% for 50bp cut in September 2025

- Shifts in expectations following weak jobs data

Treasury Yields, Dollar Index, and Stock Market Reactions

- 10-year Treasury yield dropped to 4.084% post-jobs report

- Dollar index fluctuations and early equity market volatility

Goldman Sachs CEO’s Remarks

Key Statement Summary

- CEO dismisses 50 basis point Fed cut as “not on the cards”

- Emphasis on data-driven, cautious monetary policy

Why 50bp Is Unlikely

- Limited economic justification for aggressive easing

- Tariffs’ muted impact on inflation reduces need for large cuts

Concerns Over Economic Data and Inflation

- Persistent inflation pressures from housing and food costs

- Softening labor market but not weak enough for drastic action

Emphasis on Policy Prudence

- CEO advocates for gradual rate cuts to avoid overheating economy

- Alignment with Fed’s dual mandate challenges

Market Reactions

Immediate Response in Stocks, Bonds, and Forex

- Equities: Mixed response, with growth stocks showing resilience

- Bonds: Treasury yields adjust to lower rate cut expectations

- Forex: Dollar stabilizes as 50bp cut bets fade

Investors Repricing Fed Rate Cut Expectations

- Shift toward expecting 25bp cuts in September, October, December

- Reduced anticipation for aggressive easing in 2025

Analyst Divergence

- Some analysts argue for 50bp cut due to labor market weakness

- Others align with CEO, citing inflation risks

Broader Implications

Impact on Financial Institutions and Banking

- Lower rates could pressure bank margins but boost lending

- Risk management adjustments for potential economic slowdown

Spillover Effects on Real Estate, Tech, and Crypto Markets

- Real estate: Lower rates may ease mortgage costs, spurring demand

- Tech stocks: Benefit from reduced discount rates for growth stocks

- Crypto: Potential rally if risk appetite increases with rate cuts

Global Market Implications

- European Central Bank and Asia-Pacific central banks may follow Fed’s lead

- Tariffs’ global impact could influence coordinated policy easing

Expert Opinions

Economists Supporting CEO’s View: Risks of Rapid Cuts

- Concerns over reigniting inflation if cuts are too aggressive

- Preference for gradual 25bp cuts to maintain stability

Opposing Views: Need for Stronger Stimulus

- Weak jobs data justifies bolder 50bp cut to support economy

- Risk of recession if Fed delays easing

Neutral Perspective: Fed’s Wait-and-See Approach

- Fed likely to monitor upcoming CPI and payroll data before deciding

- Possible pause in January 2025 to assess tariff impacts

Conclusion

- Summary: Goldman Sachs CEO doubts 50 basis point Fed cut in 2025

- Market outlook: Gradual 25bp cuts more likely than aggressive easing

- Open question: Will unexpected inflation declines force Fed to rethink pace?

FAQ

What Did Goldman Sachs CEO Say About Rate Cuts?

- CEO warned markets are overpricing a 50 basis point Fed cut, favoring cautious 25bp reductions.

Is the Fed Likely to Cut 50bps in 2025?

- Low probability (~11.7%) for a 50bp cut in September; 25bp cuts are more expected.

How Do Markets React to Fed Rate Cut Expectations?

- Stocks show mixed responses, bonds adjust yields, and dollar stabilizes as 50bp bets decline.

What Is the Impact of Rate Cuts on Stocks and Crypto?

- Lower rates could boost tech and crypto by reducing borrowing costs and increasing risk appetite.