Bitcoin and SOL Realized Cap Growth Slows Down While ETH Shows Strong Acceleration – Key Crypto Trends Explained

Don’t just sign up — trade smarter and save 20% with referral codes: Binance WZ9KD49N / OKX 26021839

Trusted Editorial Content: Reviewed by Industry Experts and Editors. Ad Disclosure

New on-chain data suggests that the flow of capital into Bitcoin and Solana has slowed over the past week, while Ethereum continues to show strong performance.

Ethereum and Bitcoin Show Divergent Trends in Realized Cap

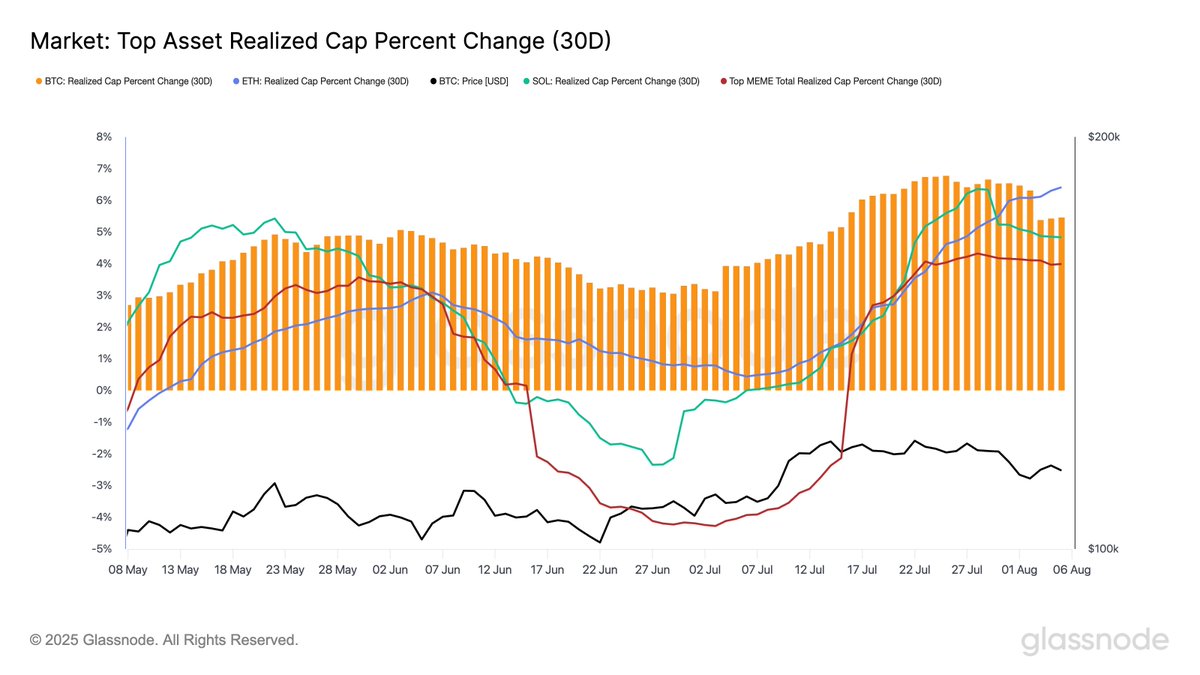

In a recent post on X, on-chain analytics firm Glassnode analyzed changes in the “Realized Cap” for several digital assets. The “Realized Cap” is a metric that calculates a cryptocurrency’s total value by assuming each token’s true value is based on the price at which it was last transacted.In simpler terms, this indicator reflects the total amount of capital that investors have invested into a given cryptocurrency. Fluctuations in the Realized Cap indicate whether money is flowing into or out of the market.Below is a chart from Glassnode showing the 30-day percentage change in the Realized Cap across various digital assets:As shown in the graph, the 30-day change in Realized Cap is currently positive for Bitcoin, Ethereum, Solana, and top memecoins, indicating an overall inflow of capital over the past month.However, the short-term trend shows some differences. A week ago, Bitcoin’s Realized Cap increased by 6.66%, and Solana by 6.34%. Now, these figures have dropped to 5.46% and 4.84%, respectively—still positive but showing a noticeable slowdown.Meanwhile, Ethereum has continued to grow, with its Realized Cap rising from 5.32% to 6.41%. This could signal a shift in investor interest, with funds moving into the second-largest cryptocurrency by market cap.The top meme coins have seen a flat trend in their Realized Cap over the past week, which Glassnode interprets as a sign of “cooling risk appetite.”Related Reading: Tether CEO: 40% Of Blockchain Fees Go To Just Moving USDTRelated Reading: Tron Re

Understanding Realized Cap and Its Significance in Crypto Markets

Understanding Realized Cap and Its Significance in Crypto Markets

In the world of cryptocurrency, understanding key metrics is essential for investors, traders, and analysts to make informed decisions. One such metric that has gained increasing attention is Realized Cap. While it may not be as commonly referenced as market capitalization (Market Cap), Realized Cap provides a more nuanced view of the true value and behavior of a cryptocurrency’s supply.

What is Realized Cap?

Realized Cap is a metric that measures the total value of all cryptocurrency units based on their last known transaction price. Unlike traditional market capitalization, which uses the current price of the asset, Realized Cap reflects the actual cost basis of the circulating supply. This means it accounts for the historical prices at which coins were moved or transacted, rather than just the current market price.

The formula for calculating Realized Cap is:

Realized Cap = Sum (Number of Coins Held by Each Address × Price at Last Transaction)

This calculation gives a more accurate representation of the “real” value of the cryptocurrency supply, as it considers the actual cost basis of each coin in circulation. It helps to avoid overestimating or underestimating the value of the asset based solely on its current price.

Why Realized Cap Matters

Realized Cap is particularly useful in analyzing the health of a cryptocurrency’s ecosystem and identifying potential market trends. Here are a few reasons why it is significant:

Market Sentiment Analysis: Realized Cap can help identify whether the market is in a bullish or bearish phase. For example, if the Realized Cap is rising while the price is falling, it could indicate that long-term holders are still confident in the asset, which may signal a potential rebound. Investor Behavior Insights: By tracking changes in Realized Cap, analysts can gain insights into how investors are behaving. A growing Realized Cap suggests that more coins are being held by long-term investors, which is often seen as a positive sign for the asset’s future performance. Volatility Assessment: Realized Cap can also be used to assess the volatility of a cryptocurrency. A stable Realized Cap relative to the price movement may indicate a more mature market with less speculative activity. Comparison Between Assets: Realized Cap allows for a more accurate comparison between different cryptocurrencies, especially when they have varying levels of liquidity or market cap.

Realized Cap vs. Market Cap

While both Realized Cap and Market Cap are important metrics, they serve different purposes. Market Cap is calculated as the current price multiplied by the total supply of a cryptocurrency. It is a quick way to gauge the overall size of the market but can be misleading during periods of high volatility.

On the other hand, Realized Cap provides a more stable and informative measure because it is based on the historical transactions of the coins. It is less affected by short-term price fluctuations and offers a clearer picture of the underlying value of the asset.

Applications in Trading and Investment

Traders and investors use Realized Cap to develop better strategies and understand the broader market dynamics. For instance:

Identifying Accumulation Phase: A rising Realized Cap alongside a falling price can indicate that institutional investors or large holders are accumulating the asset, which may lead to a future price increase. Assessing Market Maturity: A consistent or growing Realized Cap suggests that the market is becoming more mature and less speculative, which can be a sign of long-term growth potential. Tracking Whale Activity: Realized Cap can also help track the movements of large holders (whales) by analyzing the distribution of coins across different addresses and their associated transaction costs.

Conclusion

Realized Cap is an essential tool for anyone looking to understand the deeper mechanics of cryptocurrency markets. It provides a more accurate and stable measure of a cryptocurrency’s value by considering the historical cost basis of its supply. As the crypto market continues to evolve, metrics like Realized Cap will become even more critical in helping investors navigate the complexities of digital assets.

By incorporating Realized Cap into their analysis, traders and investors can make more informed decisions, avoid common pitfalls, and better anticipate market movements. In a space where volatility is the norm, having access to reliable and insightful metrics is more valuable than ever.

What Is Bitcoin (BTC) and Why It Remains the Leading Cryptocurrency

What Is Bitcoin (BTC) and Why It Remains the Leading Cryptocurrency

Bitcoin (BTC) is the first and most well-known cryptocurrency in the world. Created in 2009 by an anonymous person or group of people using the pseudonym Satoshi Nakamoto, Bitcoin introduced the concept of a decentralized digital currency that operates without the need for a central authority such as a government or bank. This revolutionary idea laid the foundation for the entire cryptocurrency industry.

At its core, Bitcoin is a peer-to-peer electronic cash system. It allows users to send and receive money directly over the internet, with transactions recorded on a public ledger called the blockchain. The blockchain ensures transparency, security, and immutability, making it extremely difficult for any single entity to alter transaction history.

The Technology Behind Bitcoin

Bitcoin’s technology is built on a combination of cryptography, distributed computing, and game theory. The blockchain is a chain of blocks, each containing a list of transactions. These blocks are linked together using cryptographic hashes, forming a secure and tamper-resistant record of all transactions ever made on the network.

Miners play a crucial role in maintaining the Bitcoin network. They use powerful computers to solve complex mathematical puzzles, which validate transactions and add them to the blockchain. In return for their work, miners are rewarded with newly created bitcoins, a process known as mining. This mechanism not only secures the network but also controls the supply of new coins, ensuring scarcity.

Why Bitcoin Remains the Leading Cryptocurrency

Despite the emergence of thousands of alternative cryptocurrencies (altcoins), Bitcoin continues to hold the position of the leading cryptocurrency. There are several reasons for this dominance:

First-Mover Advantage: As the first cryptocurrency, Bitcoin has established itself as the standard in the market. Its early adoption and widespread recognition have given it a significant edge over newer projects. Brand Recognition: Bitcoin is often the first cryptocurrency people hear about. Its name and logo are widely recognized, contributing to its status as the benchmark for other digital assets. Market Capitalization: Bitcoin consistently holds the highest market capitalization among all cryptocurrencies. This reflects investor confidence and liquidity, making it the most traded and valuable asset in the space. Adoption and Institutional Interest: Over the years, Bitcoin has gained traction among institutional investors, corporations, and even governments. Companies like Tesla and PayPal have integrated Bitcoin into their financial systems, further solidifying its legitimacy. Decentralization and Security: Bitcoin’s network is one of the most secure and decentralized in the world. Its robust infrastructure and long-standing track record make it a trusted store of value and medium of exchange.

Bitcoin as a Store of Value

In recent years, Bitcoin has increasingly been viewed as a “digital gold” or a store of value. With a capped supply of 21 million coins, it shares similarities with precious metals like gold in terms of scarcity and potential for long-term value preservation. This perception has driven demand from both individual and institutional investors looking to hedge against inflation and economic uncertainty.

Challenges and Future Outlook

While Bitcoin remains the leading cryptocurrency, it faces challenges such as scalability issues, environmental concerns related to mining, and regulatory scrutiny. However, ongoing developments like the Lightning Network aim to improve transaction speed and reduce fees, while advancements in sustainable mining practices are addressing environmental concerns.

Looking ahead, Bitcoin’s future seems promising. As more people become familiar with cryptocurrency and as adoption grows, Bitcoin is likely to maintain its position as the dominant player in the digital asset space. Its role in shaping the future of finance and technology continues to evolve, making it a key player in the global economy.

Exploring Solana (SOL) and Its Role in the Blockchain Ecosystem

Exploring Solana (SOL) and Its Role in the Blockchain Ecosystem

Solana (SOL) has emerged as one of the most prominent blockchain platforms in the rapidly evolving cryptocurrency landscape. Launched in 2020 by former Qualcomm engineers Anatoly Yakovenko and a team of developers, Solana was designed to address some of the key limitations of earlier blockchains, such as scalability, speed, and cost. With its unique architecture and high-performance capabilities, Solana has positioned itself as a strong competitor to Ethereum and other major blockchain networks.

The Technology Behind Solana

Solana’s core innovation lies in its use of a hybrid consensus mechanism that combines Proof of Stake (PoS) with a novel concept called “Proof of History” (PoH). This combination allows Solana to process transactions at an unprecedented speed while maintaining security and decentralization. Unlike traditional blockchains that rely solely on time-stamped blocks, Solana uses a cryptographic clock to record the passage of time between events, enabling nodes to verify the order of transactions without constant communication.

This approach significantly reduces the time required to validate transactions and reach consensus, allowing Solana to achieve a throughput of up to 65,000 transactions per second (TPS), far exceeding that of Ethereum or Bitcoin. The network also boasts low transaction fees, making it an attractive option for developers and users alike.

Solana’s Ecosystem and Use Cases

Solana has quickly become a hub for decentralized applications (dApps), non-fungible tokens (NFTs), and decentralized finance (DeFi) projects. Its fast and affordable infrastructure has attracted a wide range of developers, entrepreneurs, and investors looking to build scalable and efficient blockchain solutions. Some of the most notable projects built on Solana include Serum, a decentralized exchange; Phantom, a popular wallet; and Solana Beach, a platform for NFTs and digital collectibles.

Additionally, Solana’s compatibility with the Ethereum Virtual Machine (EVM) has allowed many Ethereum-based projects to migrate or deploy their applications on Solana, further expanding its ecosystem. This interoperability has contributed to Solana’s growth and adoption, making it a versatile platform for both new and existing blockchain initiatives.

Challenges and Future Prospects

Despite its impressive performance, Solana is not without challenges. Like many high-throughput blockchains, it has faced occasional network outages and scalability concerns during periods of heavy usage. These issues have sparked discussions about the long-term sustainability of its architecture and the need for continuous improvements to ensure reliability and security.

Looking ahead, Solana continues to evolve through ongoing development and community-driven innovation. The project’s roadmap includes enhancements to its consensus mechanism, improved tooling for developers, and greater integration with other blockchain ecosystems. As the demand for fast, secure, and low-cost blockchain solutions grows, Solana is well-positioned to play a significant role in shaping the future of decentralized technology.

Conclusion

Solana represents a powerful alternative to traditional blockchains, offering high throughput, low fees, and a robust ecosystem for developers and users. Its innovative approach to consensus and transaction validation sets it apart in the competitive blockchain space. As the industry continues to mature, Solana’s contributions will likely remain a key part of the broader movement toward decentralized, scalable, and accessible financial and technological systems.

How Ethereum (ETH) Is Gaining Momentum and What This Means for Investors

How Ethereum (ETH) Is Gaining Momentum and What This Means for Investors

Ethereum, the second-largest cryptocurrency by market capitalization, has been experiencing a significant resurgence in recent months. While Bitcoin often dominates headlines, Ethereum has quietly been making waves with its technological advancements, growing ecosystem, and increasing adoption. For investors, this momentum is not just a sign of potential price appreciation—it also reflects broader shifts in the blockchain and decentralized finance (DeFi) landscape.

The Evolution of Ethereum

Since its launch in 2015, Ethereum has evolved from a simple smart contract platform into a robust infrastructure for decentralized applications (dApps), non-fungible tokens (NFTs), and DeFi protocols. The network’s transition to Ethereum 2.0, which introduced a proof-of-stake consensus mechanism, has significantly improved scalability, security, and energy efficiency. These upgrades have made Ethereum more attractive to developers, users, and institutional investors alike.

Key Drivers of Ethereum’s Momentum

Adoption Growth: Ethereum continues to dominate the dApp and NFT markets, with a large portion of the total value locked (TVL) in DeFi protocols being on its network. This has led to increased transaction volumes and usage, which are strong indicators of long-term value. Enterprise Integration: Major corporations and financial institutions are increasingly adopting Ethereum-based solutions for supply chain management, identity verification, and other use cases. This real-world application helps solidify Ethereum’s position as a foundational technology. Developer Activity: A vibrant and active developer community is constantly building new tools, improving existing infrastructure, and launching innovative projects on the Ethereum blockchain. This continuous development ensures that the platform remains competitive and relevant. Market Sentiment: Positive sentiment around Ethereum has been fueled by macroeconomic factors, regulatory clarity, and the overall growth of the crypto market. As more investors look to diversify their portfolios, Ethereum’s role as a “blockchain for everything” becomes more appealing.

What This Means for Investors

For investors, Ethereum’s momentum presents both opportunities and challenges. On one hand, the network’s continued innovation and widespread adoption suggest a strong long-term outlook. On the other hand, the cryptocurrency market is inherently volatile, and Ethereum is no exception. Investors should approach it with a well-thought-out strategy, considering factors such as risk tolerance, investment horizon, and portfolio diversification.

One key aspect for investors to consider is the role of ETH as a store of value and a utility token. With the shift to proof-of-stake, staking ETH has become an attractive way to earn passive income, further enhancing its appeal. Additionally, Ethereum’s dominance in the DeFi and NFT spaces means that it could benefit from the continued growth of these sectors.

Investors should also keep an eye on upcoming developments, such as further upgrades to Ethereum 2.0, regulatory changes, and competition from other blockchains. Staying informed and adaptable is crucial in this fast-paced environment.

Conclusion

Ethereum’s growing momentum is a testament to its resilience, innovation, and adaptability. As the blockchain ecosystem continues to expand, Ethereum is well-positioned to play a central role in shaping the future of finance, technology, and digital assets. For investors, this presents a compelling opportunity—but it also requires careful analysis, patience, and a long-term perspective.

Market Trends: Comparing the Performance of BTC, SOL, and ETH

Market Trends: Comparing the Performance of BTC, SOL, and ETH

The cryptocurrency market is highly dynamic, with various assets experiencing different trends based on technological advancements, adoption rates, regulatory developments, and macroeconomic factors. Among the most prominent cryptocurrencies, Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) have each demonstrated unique performance trajectories over the past few years. This section explores the recent market trends of these three digital assets and highlights their relative strengths and weaknesses.

Bitcoin (BTC): The Market Leader

As the first and most well-established cryptocurrency, Bitcoin continues to dominate the market in terms of market capitalization and brand recognition. Over the past several years, BTC has shown a consistent upward trend, particularly during periods of macroeconomic uncertainty or institutional interest. Its limited supply of 21 million coins contributes to its perceived scarcity, which often drives long-term value appreciation.

Despite its dominance, Bitcoin has faced criticism for its slower transaction speeds and higher fees compared to newer blockchains. However, ongoing upgrades such as the Lightning Network aim to enhance scalability and usability, positioning BTC as a potential store of value rather than just a medium of exchange.

Ethereum (ETH): Innovation and Ecosystem Growth

Ethereum has established itself as the leading platform for decentralized applications (dApps) and smart contracts. With the transition to Ethereum 2.0, the network has significantly improved its energy efficiency and scalability through the implementation of proof-of-stake (PoS). These upgrades have bolstered investor confidence and attracted more developers and users to the ecosystem.

Ethereum’s native token, ETH, has also seen substantial growth, driven by increased demand for DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), and other blockchain-based services. However, high gas fees and competition from alternative Layer 1 blockchains have posed challenges that Ethereum must continue to address to maintain its leadership position.

Solana (SOL): High-Performance Alternative

Solana has emerged as a strong competitor to both Bitcoin and Ethereum, particularly due to its high throughput and low transaction costs. Leveraging a unique consensus mechanism called Proof of History (PoH) combined with Proof of Stake (PoS), Solana can process thousands of transactions per second, making it an attractive option for developers building scalable applications.

SOL has experienced significant volatility, with sharp price surges and corrections reflecting the speculative nature of the crypto market. While its performance has been impressive during bull runs, the project faces challenges related to network stability and decentralization, as evidenced by occasional outages and centralization concerns among validators.

Comparative Analysis

When comparing BTC, ETH, and SOL, it’s important to consider their distinct use cases and target audiences:

Bitcoin remains the primary choice for investors seeking a digital gold standard and long-term store of value. Ethereum continues to lead in innovation and ecosystem development, serving as the backbone for many Web3 applications. Solana offers a high-performance alternative for developers and users looking for faster and cheaper transactions, though it is still in the early stages of widespread adoption.

Ultimately, the performance of each asset is influenced by a combination of technical advancements, market sentiment, and broader economic conditions. Investors should carefully evaluate their risk tolerance and investment goals before allocating funds to any of these cryptocurrencies.

Trusted Editorial Content: FAQs on Cryptocurrency Market Trends

Trusted Editorial Content: Reviewed by Industry Experts and Experienced Editors

Ad Disclosure: On-chain data indicates that capital inflows into Bitcoin and Solana have slowed in the past week, while Ethereum has shown more resilience. In a recent post on X, on-chain analytics firm Glassnode explored how the Realized Cap has evolved for various assets in the cryptocurrency space. The Realized Cap is a capitalization model that reflects the total value of all coins in circulation based on their last movement on-chain.

Frequently Asked Questions (FAQs) About Cryptocurrency Market Trends

Question 1: What is the Realized Cap, and why is it important? Answer 1: The Realized Cap is a metric used to estimate the total value of a cryptocurrency’s supply based on the price at which each coin was last moved on the blockchain. It provides insight into the actual value of the network, rather than just the current market price, and is often used to assess long-term trends and investor behavior. Question 2: Why has the growth of Ethereum been more resilient compared to Bitcoin and Solana? Answer 2: Ethereum’s resilience could be attributed to its strong developer ecosystem, ongoing upgrades like the Merge, and increasing adoption in decentralized finance (DeFi) and NFTs. These factors contribute to sustained demand and network activity, even during periods of slower capital inflows for other cryptocurrencies. Question 3: What does it mean when capital inflows slow down for a cryptocurrency? Answer 3: A slowdown in capital inflows typically suggests reduced investment or buying pressure for a particular asset. This could be due to market uncertainty, regulatory changes, or shifts in investor sentiment. However, it doesn’t always indicate a negative trend, as it might also reflect a period of consolidation or re-evaluation. Question 4: How do industry experts analyze on-chain data to understand market movements? Answer 4: Experts use on-chain analytics tools to track metrics such as wallet activity, transaction volumes, and network usage. These insights help identify patterns, such as whale movements, token distribution, and overall network health, which can inform investment decisions and market forecasts. Question 5: Can the Realized Cap be used to predict future price movements? Answer 5: While the Realized Cap offers valuable insights into the underlying value of a cryptocurrency, it should not be used in isolation to predict future price movements. It works best when combined with other indicators, such as trading volume, market capitalization, and macroeconomic factors.