Factors Driving Crypto Market Confidence & Macro Risks

Table of Contents

- Key Takeaways

- Factors Strengthening Crypto Market Confidence

- Macro Risks to Address

- Detailed Report

- Drivers of Market Confidence

- Macro Risks to Navigate

- Conclusion

- Key References

- Commentary

- Factors Driving Crypto Market Confidence & Macro Risks

- Key Factors Boosting Crypto Market Confidence

- 1. Institutional Capital Inflows & Improved Liquidity

- 2. Regulatory Clarity & Improved Market Expectations

- 3. Technological Advancements Driving Industry Growth

- 4. Favorable Macro Environment for Crypto Assets

- Macro Risks Facing the Crypto Market

- 1. Risk of a Global Economic Recession

- 2. Uncertainty in Regulatory Policies

- 3. Impact of a Strong U.S. Dollar & Interest Rate Changes

- 4. Black Swan Events Within the Crypto Industry

- Conclusion

Key Takeaways

- Research indicates that crypto market confidence in 2025 is bolstered by Fed rate cuts, Bitcoin ETF approvals, and Trump-backed policies.

- It seems highly likely that emerging markets (e.g., Southeast Asia, Latin America) and stablecoin growth are also driving optimism.

- Evidence suggests macroeconomic risks include policy uncertainty, inflation volatility, and geopolitical tensions.

Factors Strengthening Crypto Market Confidence

In 2025, the cryptocurrency market is experiencing a notable surge in confidence, driven by several pivotal factors. First, the U.S. Federal Reserve is expected to lower interest rates to a range of 4%-4.25%, reducing borrowing costs and boosting interest in high-risk assets like crypto. According to a Fidelity report, past rate-cut cycles—such as in 2020—have historically fueled Bitcoin rallies, with returns exceeding 150% in 2023 alone.

Second, the approval of Bitcoin ETFs has significantly accelerated institutional adoption. In 2024, U.S.-approved spot Bitcoin ETFs attracted over $50 billion in inflows, with major players like BlackRock and Fidelity leading the charge. Data from CoinVoice shows that approximately 28% of U.S. adults—around 65 million people—own crypto in 2025, nearly doubling over the past three years.

Additionally, pro-crypto policies under the Trump administration, such as the proposed Strategic Bitcoin Reserve (SBR), have further solidified market optimism. Analysts project Bitcoin could hit $200,000 in an optimistic scenario, reflecting the potential impact of such governmental backing.

Emerging markets and stablecoin growth also play a critical role. Stablecoin market capitalization grew 48% in 2024 to $193 billion, with transaction volumes surpassing $27 trillion, per CoinVoice. Countries like the Philippines (20% adult adoption) and Brazil (150% stablecoin volume growth in 2024) highlight the expanding global footprint.

Macro Risks to Address

Despite this bullish outlook, macroeconomic risks loom large. Policy uncertainty remains a primary concern. In the U.S., while the regulatory environment has improved, shifts in SEC leadership or market conditions could tighten rules, potentially slashing market share to 30% in a pessimistic scenario. China’s regulatory stance adds further complexity—Hong Kong’s relaxed policies have drawn capital, but mainland bans could disrupt global liquidity.

Inflation and employment volatility pose another threat. December 2024’s core CPI stood at 2.9%, above the Fed’s 2% target, raising fears of a “second wave” of inflation, per Fidelity. With 2025 core PCE projected at 2.3%-2.5% and unemployment steady at 4.0%-4.1%, any economic slowdown could trigger market turbulence.

Geopolitical tensions round out the risks. The Eurozone’s 2025 growth is forecasted at just 1.0%, per CoinVoice, and capital flow disruptions from global conflicts could amplify crypto’s systemic risks. Past events like the FTX collapse (2022) underscore the fragility of trust and platform resilience.

Detailed Report

Drivers of Market Confidence

The crypto market in 2025 is riding a wave of optimism, underpinned by a confluence of economic, institutional, and technological factors:

- Federal Reserve Rate Cuts: Anticipated cuts to 4%-4.25% by year-end 2025 are set to enhance liquidity. Historical patterns show crypto thrives in low-rate environments—Bitcoin’s 400% surge in 2020-2021 and 150% return in 2023 underscore this trend, per Fidelity.

- Institutional Adoption via ETFs: The 2024 approval of spot Bitcoin ETFs has been a game-changer, drawing $50 billion in institutional capital. With 28% of U.S. adults (65 million) now holding crypto, per CoinVoice, the market has gained mainstream traction.

- Trump’s Pro-Crypto Stance: Proposals like the Strategic Bitcoin Reserve aim to position Bitcoin as a national asset, potentially pushing prices to $200,000 in a best-case scenario. This policy shift signals a broader governmental embrace of digital assets.

- Stablecoins and Emerging Markets: Stablecoins, with a 48% market cap increase to $193 billion and $27 trillion in transactions in 2024, have become a global payment backbone. Emerging markets like Brazil (150% stablecoin volume growth) and the Philippines (20% adoption) are key growth engines, per CoinVoice.

- Web3 and DeFi Innovation: DeFi’s total value locked (TVL) rebounded from a 2024 low of $40 billion to $120 billion, with Layer 2 solutions growing 200%. AI-driven projects, like decentralized identity systems, are expanding use cases and adoption.

| Factor | Details | Data |

|---|---|---|

| Fed Rate Cuts | Lower borrowing costs boost risk assets | 2025 rates at 4%-4.25%; 2023 BTC return 150% |

| Bitcoin ETFs | $50B inflows, institutional buy-in | 28% U.S. adults (65M) hold crypto in 2025 |

| Trump Policies | Strategic Bitcoin Reserve; $200K BTC potential | – |

| Stablecoin Growth | 48% market cap rise, $27T in transactions | Brazil: 150% volume growth in 2024 |

| Web3/DeFi | TVL at $120B, Layer 2 up 200% | – |

Macro Risks to Navigate

While confidence is high, macroeconomic headwinds could derail progress:

- Policy Uncertainty: In the U.S., SEC shifts could shrink market share to 30% in a worst-case scenario. China’s dual-track approach—Hong Kong’s seven exchanges (40% mainland users) versus mainland bans—creates global liquidity risks, per CoinVoice.

- Inflation and Employment: Core CPI at 2.9% in December 2024 signals persistent inflation, potentially delaying rate cuts. With 2025 core PCE at 2.3%-2.5% and unemployment at 4.0%-4.1%, economic softening could hit crypto hard, per Fidelity.

- Geopolitical Tensions: Eurozone growth at 1.0% in 2025 reflects global economic strain. Capital flow disruptions and events like the FTX collapse highlight crypto’s vulnerability to trust and systemic shocks.

| Risk Category | Details | Data |

|---|---|---|

| Policy Uncertainty (U.S.) | SEC tightening could cut market share to 30% | – |

| Policy Uncertainty (China) | Hong Kong gains vs. mainland bans affect liquidity | 7 HK exchanges, 40% mainland users in 2024 |

| Inflation/Employment | 2.9% CPI may delay cuts; economic slowdown risk | 2025 PCE 2.3%-2.5%, unemployment 4.0%-4.1% |

| Geopolitical Tensions | Capital flow risks, systemic shocks | Eurozone 2025 growth at 1.0% |

Conclusion

The crypto market in 2025 is buoyed by Fed rate cuts, institutional adoption, supportive policies, stablecoin expansion, and technological innovation. Yet, policy uncertainty, inflation pressures, and geopolitical risks demand vigilance. Investors should monitor regulatory shifts, diversify portfolios, and leverage DeFi and stablecoin tools to mitigate volatility. In this transformative era, balancing optimism with caution will be key to long-term success.

Key References

source:Grayscale

-

Growing Market Confidence

-

U.S. digital asset policy is shifting, boosting institutional investor confidence.

-

M&A, stablecoin investments, and asset tokenization saw a resurgence in March.

-

-

Market Volatility & Macroeconomic Factors

-

Despite improved fundamentals, crypto valuations slightly declined in March but remain attractive long-term.

-

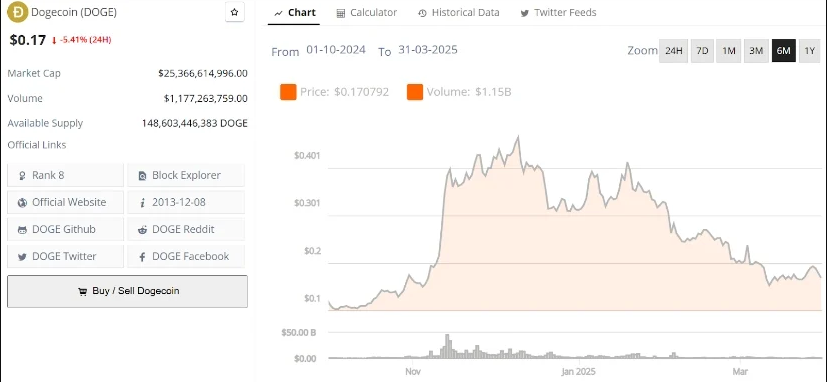

Valuations are influenced by macroeconomic factors like stock market performance, the U.S. dollar, and gold price fluctuations.

-

-

Macroeconomic Risks & Policy Uncertainty

-

Tariffs and government policies remain uncertain, but markets have priced in some economic slowdown risks.

-

No expectations of major government spending cuts or severe trade wars.

-

-

Investment Opportunities

-

Market corrections since early 2025 may present good entry points for new investors.

-

-

Market Performance

-

The market declined in March: the crypto industry index fell 5%, and Bitcoin dropped 2%.

-

U.S. equities and fixed-income markets were weak, while the dollar softened—historically aligning with Bitcoin’s performance trends.

-

Commentary

-

Institutional Involvement Signals Long-Term Growth

-

The return of institutional investors suggests the digital asset market is maturing, which could lead to more stable long-term growth.

-

-

Policy Uncertainty Remains

-

While looser U.S. regulations support crypto growth, future regulatory changes—especially for stablecoins and asset tokenization—need close monitoring.

-

-

Crypto Assets Still Tied to Macro Trends

-

Bitcoin and other cryptocurrencies remain influenced by traditional financial markets, including fluctuations in the dollar, stocks, and gold, indicating they haven’t fully decoupled from macroeconomic forces.

-

-

Market Corrections Offer Strategic Entry Points

-

Recent valuation declines may present attractive buying opportunities for long-term investors, but macroeconomic uncertainty and regulatory risks should still be considered.

-

Overall, while the crypto market faces short-term adjustments, growing institutional interest suggests strong long-term growth potential.

Factors Driving Crypto Market Confidence & Macro Risks

In recent years, the crypto market has gone through multiple boom-and-bust cycles. Currently, market confidence is gradually recovering, driven by institutional capital inflows, technological advancements, and evolving regulatory frameworks. However, the market still faces uncertainties, including macroeconomic volatility and regulatory shifts. This article explores the key factors boosting crypto market confidence and the macro risks that investors should be aware of.

Key Factors Boosting Crypto Market Confidence

1. Institutional Capital Inflows & Improved Liquidity

Since 2024, traditional financial institutions have increased their exposure to crypto assets. The launch of Bitcoin spot ETFs has enabled institutional investors to allocate funds to Bitcoin in a regulated manner, leading to significant capital inflows. Additionally, the rise of real-world asset (RWA) tokenization is further driving institutional participation in the crypto market.

2. Regulatory Clarity & Improved Market Expectations

While global crypto regulations remain fragmented, the overall trend is toward greater clarity. For example, the U.S. may ease restrictions on stablecoins, the EU’s MiCA framework has been implemented, and pro-crypto stances in regions like Hong Kong and Singapore are fostering positive market sentiment. These developments increase optimism for long-term regulatory clarity.

3. Technological Advancements Driving Industry Growth

The maturation of Layer 2 solutions, the rise of new DeFi models, and the growing adoption of Bitcoin Ordinals and BRC-20 tokens are injecting fresh momentum into the market. Meanwhile, Ethereum’s continuous upgrades (such as Danksharding and EIP-4844) aim to lower gas fees and improve network scalability, further strengthening investor confidence.

4. Favorable Macro Environment for Crypto Assets

As global economic uncertainty grows, Bitcoin’s role as a “digital gold” hedge is becoming more pronounced. If the Federal Reserve slows down rate hikes or shifts toward rate cuts, liquidity could flow from traditional markets into crypto assets, further boosting market sentiment.

Macro Risks Facing the Crypto Market

1. Risk of a Global Economic Recession

Concerns about a potential U.S. recession are rising. If the economy slows down, investors may reduce exposure to high-risk assets, including crypto. Additionally, an economic downturn could lead to tighter liquidity conditions, negatively impacting the crypto market.

2. Uncertainty in Regulatory Policies

While some regions are providing clearer regulatory guidance, sudden policy shifts remain a risk. The unresolved regulatory jurisdiction battle between the SEC and CFTC in the U.S., unclear DeFi regulations in the EU, and shifting policies in Asian markets could all impact crypto’s growth trajectory.

3. Impact of a Strong U.S. Dollar & Interest Rate Changes

If the Federal Reserve maintains high interest rates or continues raising them, the U.S. dollar could strengthen, drawing capital back to traditional financial markets and reducing the appeal of crypto assets. A high-interest-rate environment also makes low-risk assets like government bonds more attractive compared to crypto.

4. Black Swan Events Within the Crypto Industry

Historically, the crypto market has suffered significant downturns due to internal crises, including exchange collapses, project failures, and smart contract exploits. If another major incident occurs, market confidence could be severely impacted, triggering cascading sell-offs.

Conclusion

The crypto market is gradually regaining confidence, driven by institutional investments, technological advancements, and clearer regulatory frameworks. However, investors must remain vigilant about macroeconomic shifts, regulatory uncertainties, and potential industry-specific shocks. For long-term investors, adopting a strategic approach—such as diversifying investments and managing risks during market corrections—remains key to navigating uncertainties effectively.