Dogecoin Price Prediction: Can DOGE Avoid a $0.10 Retest and Break Above $0.30?

Don’t just sign up — trade smarter and save 20% with referral codes: Binance WZ9KD49N / OKX 26021839

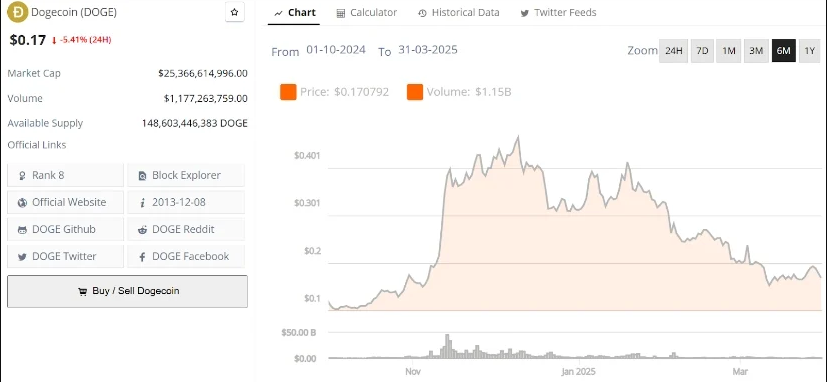

Recently, Dogecoin (DOGE) has been under constant pressure, sparking debates among analysts about whether the popular meme coin can reverse its downtrend and push toward the $0.30 mark.

Market indicators reveal an ongoing battle between bulls and bears at key levels, making DOGE’s short-term trajectory uncertain. Some investors are optimistic about its potential rebound, while others worry about further declines.

Key Technical Analysis

Crypto analyst Moein Haddadian noted that DOGE has broken out of a descending trendline, a technical signal that selling pressure may be easing. However, key resistance levels remain a challenge. For a strong recovery, DOGE must first surpass the critical $0.25 price level.

Haddadian stated, “A confirmed breakout above this level could shift momentum in favor of the bulls, potentially driving the price toward $0.30.”

Key Resistance and Support Levels

Despite some bullish momentum, DOGE continues to hover near crucial support levels. The $0.16 level has emerged as a vital support zone. If this level holds, analysts anticipate a consolidation above $0.205, potentially setting the stage for a rally toward the $0.30–$0.334 range. However, a drop below $0.16 could push the price down to $0.122 or even $0.113.

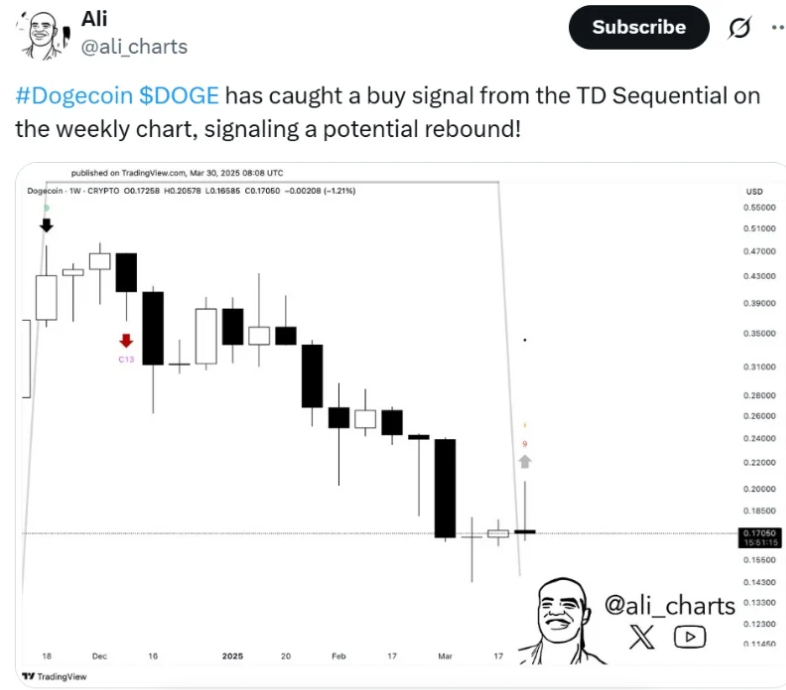

Renowned crypto analyst Ali Martinez has also weighed in on DOGE’s outlook. He highlighted $0.21 as a significant resistance level. According to his SuperTrend indicator analysis, a close above this resistance could confirm the start of a new bullish cycle for DOGE. On the other hand, failure to break through may result in sideways movement or even a downturn.

Market Sentiment: Will DOGE Reverse Course?

The broader crypto market remains highly volatile, and DOGE is no exception. Analysts are divided on its short-term trajectory. Some believe it’s on the brink of a major breakout, while others warn that increasing selling pressure could send it back to $0.10.

Historical trends suggest that Dogecoin’s price action follows cyclical patterns, often leading to explosive rallies. Crypto trader DogeCapital pointed out that DOGE’s current movement closely resembles past fractals that preceded massive growth phases. If history repeats itself, Dogecoin could be gearing up for a significant upward move.

However, market analyst Henry cautions that DOGE is at a crucial juncture. He explained, “While Dogecoin has shown strength, failure to sustain momentum above key resistance levels could result in another pullback before any potential rally.”

Long-Term Outlook: Can DOGE Reach $1?

While short-term price movements remain uncertain, some analysts hold a bullish long-term view on DOGE. If the coin can establish sustained momentum, it could eventually aim for $1 or even higher.

For now, Dogecoin’s price prediction hinges on its ability to break past crucial resistance levels and maintain bullish support. Its strong community backing and growing adoption may serve as tailwinds, but the battle between buyers and sellers remains intense.

Final Thoughts

Dogecoin investors are at a critical crossroads. If DOGE can hold key support levels and break past $0.25, it may pave the way for a push toward $0.30. However, failure to do so could lead to further declines, potentially retesting the $0.10 mark. As always, market participants should closely monitor resistance levels, investor sentiment, and broader market trends before making any decisions.